Record-Breaking 2021 Freight Volumes in the U. S. – Trucks will be 100% Utilized and Truck Services Will be Stressed to Maximum Limits.

The new U.S. Postal Service delivery trucks have been received with mixed reviews. Many are appalled to learn the current fleet lacks even the most basic of amenities like A/C, heating and airbags, so the upgrades seem like table stakes. Twitter users were quick to question whether Pixar designed the cartoonish body fabricated with a tall body to accommodate more packages stemming from e-commerce.

And while the trucks won’t hit the road until 2023, the National Retail Federation is forecasting A LOT more packages from e-commerce this year. Here’s what I’ve got to guide you into the weekend:

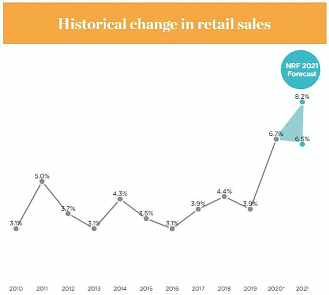

- The NRF expects retail sales to grow between 6.5% and 8.2% this year, driven by 18% to 23% online sales growth.

- The new Postal Service trucks are disappointing, but it has nothing to do with the look.

NRF forecast suggests no end to the freight bull market in sight

Retail sales are expected to grow this year between 6.5% and 8.2%, amounting to more than $4.33 trillion, according to the National Retail Federation’s annual sales forecast released Wednesday.

Preliminary results indicate retail sales grew 6.7% in 2020, despite the challenges from the global health crisis. That total nearly doubles the NRF original forecast of 3.5% prior to the pandemic and was driven by sky-high online demand that totaled 22% of all spending by year’s end. This year, the NRF forecasts online sales to maintain a pressing pace between 18% and 23% growth over last year to hit $1 trillion for the first time.

“The trajectory of the economy is predicated on the effectiveness of the vaccine and its distribution,” said NRF Chief Economist Jack Kleinhenz in the press release.

“Our principal assumption is that the vaccination will be effective and permits accelerated growth during the midyear. The economy is expected to see its fastest growth in over two decades.”

Kleinhenz noted that this year marks the second year of elevated savings rates, record-high stock valuations, increased home prices, enhanced government support and record-low interest rates, which are all contributing factors toward the economy and consumer spending behavior.

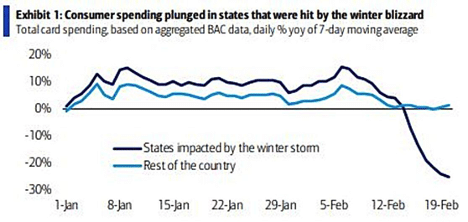

How’s spending right now? Consumers have continued to carry the economy through the first two months of 2021. In the most recent week of data from Bank of America, spending hit a deep freeze when much of the country was hit with harsh and unexpected winter storms.

The blizzard that rampaged the South and left millions without power created major disruptions to economic activity. The BofA team found particular weakness in spending in Texas, Louisiana, Oklahoma, Mississippi, Arkansas and Tennessee. Combined card spending in these six states ran at a -25% yoy pace for the seven days ending last Saturday. If these states are withheld, total card spending increased 1.3% yoy over the same period, which was likely still held down by poor weather conditions given the breadth of the blizzard.

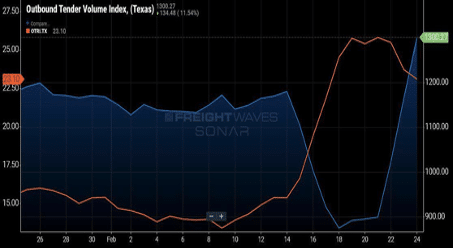

But it’s been 65 degrees and sunny in much of Texas this week. We need not look any further than our own Outbound Tender Volume Index to see the rapid rebound in the Texan economy. Volumes have already snapped back from the fleeting 25% decline to a year-to-date high.

In its forecast, the NRF warned that households will still consume retail goods this year, but revert back to services as they are available. Normally, 70% of consumer spending goes toward services and we should expect Americans to shift some goods spending back this year. But this doesn’t phase retailers and importers that continue to bring exorbitant volumes through our ports. Port of LA Executive Director Gene Seroka said the port handled 14.5% more containers yoy in January, and is expecting to take in 34% more containers in February than it did this time last year. Seroka insisted we remember that port volumes were very low from February to May of last year, so year-over-year comparisons will be distorted.

But the fact is this is not a typical February or Lunar New Year. “Lunar New Year looks a lot different this year. A lot of factories stayed open during the holiday. Some have called workers back from an abridged holiday setting. They’re playing catch-up with orders too. … It truly is a supply chain phenomenon. The manufacturers are behind on orders. We can’t fill the shelves fast enough at our retail level,” Seroka said.

Seroka is correct. The inventory data for January has not been released yet, but in the most recent month available, the inventory-to-sales ratio was at its lowest point in more than six years. And anecdotally, both of the two retailers I frequent for weekly food and essentials are comically understocked. There were no eggs at either store for most of last week. EGGS!

Final thoughts. There is no definitive end for this freight bull market in sight. Consumers continue to spend on goods, driving freight and diminishing already depleted inventories. Even if consumer spending diverged from its current trajectory (which I see as unlikely, especially given the additional stimulus, accelerating vaccine rollout and strong consumer balance sheet), the mass inventory restocking ahead will be sufficient to keep freight flowing from a consumer perspective.

In addition to consumer goods demand, the housing market is white hot and there’s a blooming recovery in our industrial economy underway. All of these variables, along with a week of catching up from the winter storms, are converging just as the spring freight season kicks off.

Expect the highways and roads to be choked full with Trucks and delivery vehicles desperately trying to fill demand for goods movement. All trucking services will be overloaded and maximum fleet utilization will be stressed to the max. All services for trucks will likely rise in price and frequency due to unparalleled demand.