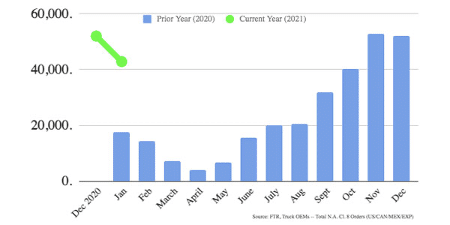

New Truck Orders Forecast: Class 8 truck orders exceed 40k units for the fourth consecutive month

FTR reports preliminary North American Class 8 net orders for January remained elevated at 42,800 units. January is the fourth consecutive month for Class 8 orders to exceed 40,000 units. January order activity was -18% m/m and +144% y/y. Orders for the previous twelve months now total 308,000.

Freight growth remains vibrant and fleets are rushing to add capacity as fast as possible, FTR says. OEMs and suppliers are trying to keep pace with the surging demand. Fleets continue to place orders out to the end of the year to acquire trucks as they become available.

“Currently there are shortages of raw materials and component parts, which will result in supply being unable to meet the demand of Class 8 trucks in the short-term,” said Don Ake, vice president of commercial vehicles for FTR. “Class 8 suppliers are working diligently to ramp up production but are hindered by the pandemic and material shortages. In addition, imported parts deliveries are being delayed up to two weeks at the ports.

“The supply chain is struggling after the surge in demand following the economic restart. Now companies are having problems hiring back enough workers due to virus concerns and protocols. Also, the steel plants took longer than expected to fire back up. Demand for Class 8 trucks is surging, but the supply chain is hindered. Our industry is very skilled and experienced in dealing with roadblocks. It will handle this situation better than other sectors. However, this will limit first-quarter production and will probably run over into part of Q2. When the vaccine enables employment to increase and the other bottlenecks are removed, this will end up being a robust year for Class 8 sales.”

ACT Research reports NA Classes 5-7 demand, with orders at 25,300 units, slid 28% sequentially but were still up 26% compared to last January.

“Despite January’s preliminary net order moderation, the pandemic-driven shift in consumer spending from experiences to goods remains a benefit for the providers of local trucking services, and the symbiotic relationship between heavy-duty freight rates and medium-duty demand continues to impact this market segment,” said Kenny Vieth, ACT’s president and senior analyst.

It’s also good to know:

Truck classification in the United States

In the United States, commercial truck classification is determined based on the vehicle’s gross vehicle weight rating (GVWR). The classes range from 1–8. Trucks are also classified more broadly by the Federal Highway Administration (FHWA), which groups classes 1–2 as light duty, 3–6 as medium duty, and 7–8 as heavy duty; a commercial driver’s license (CDL) is generally required to operate heavy-duty trucks. The Environmental Protection Agency (EPA) has a separate system of emissions classifications for trucks. The United States Census Bureau also assigned classifications in its now-discontinued Vehicle Inventory and Use Survey (VIUS) (formerly Truck Inventory and Use Survey (TIUS)).

Table of US GVWR classifications

| US truck class | Duty classification | Weight limit | Examples |

| Class 1 | Light truck | 0–6,000 pounds (0–2,722 kg) | Chevrolet Colorado/GMC Canyon, Ford Ranger, Honda Ridgeline FWD[8], Jeep Gladiator, Nissan Frontier, Toyota Tacoma |

| Class 2a | Light truck | 6,001–8,500 pounds (2,722–3,856 kg) | Chevrolet Silverado/GMC Sierra 1500, Ford F-150, Honda Ridgeline AWD[8][9][10], Lexus GX, Lexus LX, Nissan Titan, Ram 1500, Toyota Tundra |

| Class 2b | Light/Medium truck | 8,501–10,000 pounds (3,856–4,536 kg) | Chevrolet Silverado/GMC Sierra 2500, Ford F-250, Nissan Titan XD, Ram 2500[8][9][10] |

| Class 3 | Medium truck | 10,001–14,000 pounds (4,536–6,350 kg) | Chevrolet Silverado/GMC Sierra 3500, Ford F-350, Ford F-450 (pickup only), Ram 3500 Isuzu NPR[11] |

| Class 4 | Medium truck | 14,001–16,000 pounds (6,351–7,257 kg) | Chevrolet Silverado 4500HD/International CV, Ford F-450 (chassis cab), Ram 4500[8] Isuzu NPR-HD,[11] |

| Class 5 | Medium truck | 16,001–19,500 pounds (7,258–8,845 kg) | Chevrolet Silverado 5500HD/International CV, Ford F-550, Ram 5500 Isuzu NRR,[11] Freightliner Business Class M2 106, Kenworth T170, Peterbilt 325 |

| Class 6 | Medium truck | 19,501–26,000 pounds (8,846–11,793 kg) | Chevrolet Silverado 6500HD/International CV, Ford F-650, Freightliner Business Class M2 106, International MV[12], Kenworth T270, Peterbilt 330 |

| Class 7 | Heavy truck | 26,001–33,000 pounds (11,794–14,969 kg) | Autocar ACMD,[13] Freightliner Business Class M2 106, Ford F-750[14], Hino 338, International MV, Kenworth K370, Kenworth T370 and T440/470, Mack MD, Peterbilt 220 and 337/348 |

| Class 8 | Heavy truck | 33,001 pounds (14,969 kg) and above | Autocar ACX and DC; Freightliner Cascadia, Business Class M2 112, 118SD, and EconicSD; Ford F-750; Hino XL8; International LT, HV, and RH; Kenworth T680, T880, and W990; Mack Anthem, Granite, Pinnacle, and TerraPro; Peterbilt 389,[15] 579, and 520; Western Star 4800, 4900 and 5700 |

Article by David Sickels, the Associate Editor of Tire Review and Fleet Equipment magazines.

Learn more about your opportunity in trucking industry!