The 2021 cargo traffic jams on the world’s roads, seas and air corridors could easily continue into next year, continuing to increase shipping costs, according to the head of one of the biggest U.S. freight brokers.

“The domestic freight markets are extremely dislocated and the global air-freight and ocean markets have tremendous amounts of constraints around them,” said Bob Biesterfeld, chief executive officer of C.H. Robinson Worldwide Inc. “We could be standing up a pretty strong freight market throughout 2021, if not into 2022.”

That promises a windfall for truckers, air-freight companies and maritime shipping lines. Retailers, manufacturers and anyone else who pays to get goods across the globe will get pinched.

As a broker, contracting with carriers on behalf of shipping customers, C.H. Robinson can get squeezed when long-term contracts don’t keep pace with spot costs but adjust as new contracts are negotiated. The Eden Prairie, Minnesota-based company projects an adjusted operating margin of 40% for its North America Surface Transportation unit this year, improved from about 33% last year. As a result, EP will be adding Trucks and drivers.

Annual contracts for long-haul trucking will probably rise in the low-double-digit percentages this year, driven by spot rates that have jumped 35% from a year ago, Biesterfeld said in an interview. Air-freight prices have almost doubled from a year ago.

Maritime rates have surged the most. The cost of shipping a 40-foot container from Hong Kong to Los Angeles has nearly quadrupled in the last year, said Bloomberg Intelligence analyst Lee Klaskow, based on data from research firm Drewry.

The crunch developed as people who were barred by the Covid-19 pandemic from going to movies, concerts and restaurants spent their money on flour and treadmills instead. The effect was magnified in countries where citizens received government relief. Shortages of trucks and drivers, in some cases because of enhanced unemployment benefits, contributed to supply-chain bottlenecks. So, too, has the reduction in airline flights, which typical carry some freight.

And the seaborne freight industry is tapped out. The Port of Los Angeles, the busiest in the U.S., is operating above what is considered full capacity in a normal market, JPMorgan Chase & Co. analyst Brian Ossenbeck said in a note Monday.

“There’s no fast way to recover there,” Biesterfeld said. “There are no extra ships sitting around waiting to be deployed.” Customers that normally could book a container days before shipping now have to act weeks in advance. Some companies in desperation are turning to more-expensive air freight.

“We’re running weekly charters today from the EU to the U.S. and from Shanghai to the U.S., just to keep up with the incremental demand coming from our customers,” he said. “The demand is pent up and it continues to remain strong.”

Class 8 Truck orders Explode as 2021 Approaches

The tremendous volume reflects several large fleets placing their requirement orders for the entirety of 2021 to lock up build slots, which are they perceive to could in short supply next year.

FTR Intel reports Class 8 orders for December 2020 exploded to the third-highest total ever at 52,600 units – the best performance since August 2018.

Orders were +31% m/m and almost (3) times the level of November 2019. Class 8 orders for the past twelve months continue to increase and now stand at over 250,000 units.

“The Class 8 market is trying to rebalance after suffering through woeful order numbers early in the pandemic,” said Don Ake, vice president of commercial vehicles for FTR. “The huge November orders mean that Q4 will be a fabulous one, regardless of what comes in for December and that portends well for the expected increase in production early next year.”

The tremendous volume reflects several large fleets placing their requirement orders for the entirety of 2021 to lock up build slots, which they perceive could be in short supply next year. Fleet confidence remains solid entering 2021, as carriers are getting their truck orders in early for next year’s deliveries. Consumer-oriented freight remains vibrant and industrial freight is expected to improve in the coming months. Fleets are placing big orders anticipating needing more trucks throughout next year.

Orders should begin to wind down in the next several months as the large fleets conclude their seasonal ordering. The November orders are great news for the industry. These orders are pumping up the backlog which had dropped to a three-year low in September. According to FTR, the higher backlog would indicate that the industry will have a stable, positive year in 2021 – a welcome relief after the shock and chaos of 2020.

“Fleets are still trying to catch-up with the jump in freight volumes resulting from the economic restart and the generous stimulus money which is being spent predominately on consumer goods and food. This will only intensify if there is a second round of payouts.”

Wabash National trailer order backlog suggests a strong 2021

Wabash National Corp. (NYSE: WNC) saw a 37% increase in its order backlog between the second and third quarters. That suggests a strong 2021 — if Wabash can find enough workers to build the dry vans and last-mile truck bodies it makes.

“Labor rather than physical capacity is likely to be the most significant constraint across a vast array of manufacturers in 2021,” Wabash National CEO Brent Yeagy said on the company’s third-quarter earnings call Thursday.

“The labor market is unlike anything we’ve seen before,” he said. “A 10% unemployment rate is now more like a 3% rate of unemployment. For a multitude of reasons, labor has become exceptionally difficult to find.”

Just like with truck drivers, furloughs during manufacturing shutdowns in March and April created a worker shortage. Companies are trying to make up for in industries like home delivery that are thriving during the pandemic. Federal unemployment benefits on top of state jobless pay prompted many workers to pass on going back to work when their jobs were available.

Attracting workers could get harder if extended unemployment benefits are part of a new federal stimulus package.

Tale of two customers

For Wabash National, it is a tale of two customers. The first is well-financed motor carriers increasing orders for dry vans to take advantage of record-high per-mile freight rates. The order backlog stood at nearly $1 billion at the end of the quarter.

But more than 50% of Wabash National’s business comes from nonprofessional businesses trying to weather the crushing business impact of COVID.

“Whether it’s a flower shop, a dry cleaner or an appliance store, delivery is a component of their business,” Yeagy said. “But not their main business. Many of these customers may not have been classified as essential businesses during the state-mandated lockdowns.”

That took a toll on Wabash National’s Final Mile Products business. The division is still absorbing the September 2017 purchase of Supreme Industries. The segment is running below break-even levels in 2020.

“The final-mile group is being impacted by an out-of-the-blue black swan pandemic that has a disproportionate impact,” he said.

Still, Yeagy is optimistic.

“The demand for final-mile equipment will be reversed in coming years as customers most impacted by COVID get their feet back under them,” he said. “As with most cycles, the segments that fall the hardest also rebound the quickest.”

Dry van demand

The demand for dry vans to replace older equipment and to expand capacity led to the second-highest trailer orders on record in September. Wabash National shipped 8,415 trailers in the third quarter. The average price of $27,000 each was up 1% from the same quarter a year ago.

“We have seen our market share expand from the high teens to the mid-20% range aided by the physical and supply chain-related capacity that was constrained in 2018 and 2019,” Yeagy said.

Industrywide trailer production in 2021 could be around 230,000. Wabash National could account for 41,000 of those expected builds. Customer discussions point to firm orders continuing in October, Yeagy said.

“Anytime you see 30% changes in stock rates from the second quarter to the third quarter, we get the attention of the professional carriers,” he said. “That initial pull is very well thought out initial buying decisions. “I think we can look at 2021 as being a relatively significantly improved year from 2020.”

Wabash National earned $3.9 million, or 7 cents per diluted share, in the quarter on revenue of $351.6 million. Company shares rose 10.52% Thursday to close at $16.92.

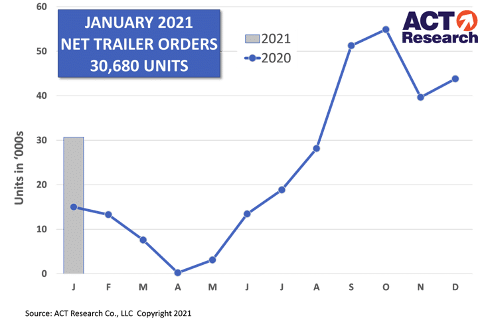

January 2021 trailer orders up 105% compared to January 2020

January 2021 net U.S. trailer orders fell more than 30% from December 2020, but rose nearly 105% compared to January 2020.

Before accounting for cancellations, new orders of 32,680 units were down 30% versus December 2020, but 91% better than the previous January, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

“That continued the growth of the order board, as orders were 66% above current build rates, and generates a conundrum for OEMs,” said Frank Maly, director of CV transportation analysis and research at ACT Research. “Open production slots now come with 2022 dates, and OEMs, concerned about component and materials costs, are hesitant to extend pricing commitments that far.”

U.S. trailers report provides a monthly review of the current U.S. trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments.

“Large fleets, driving much of the current demand, may also be hesitant to extend CAPEX plans that far,” Maly added. “In the middle, small to medium fleets are struggling to recover from COVID lockdowns. Expect some order softness until production grows.”